Even in the most stable of times, economic forecasting is an imprecise art. Now, during the coronavirus crisis, all forecasts are subject to a very high degree of uncertainty. They depend not only on an assessment of the unprecedented economic conditions but also on medical progress, including treatment and vaccine development, in the fight against COVID-19. But let’s work with what we have.

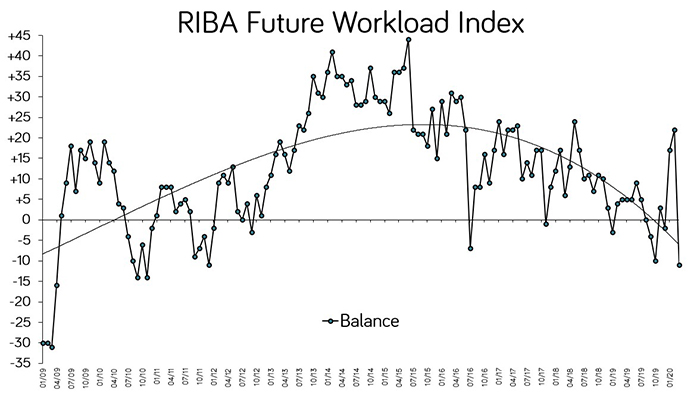

Since 2009 the RIBA has been monitoring architects’ views of their future workloads. Through a monthly survey, we derive the “RIBA Future Workload Index”. You can see the results online. Over the years, it has anticipated, for example, the effects of government capital stimulus after the financial crisis, the workload reduction brought by austerity, the slow recovery through to 2016, then the effects of Brexit uncertainty, post the 2016 referendum. It’s a good place to start when looking at what might be ahead for practices.

Current RIBA Future Workload Index figures are unprecedented. In March, the index posted its largest drop in one month. In April, it looks set to be the lowest balance score we’ve seen, and by some way. Never before have such a proportion of architects predicted that their workload will fall in the next three months. At first sight, this is very bleak. But it shouldn’t surprise us. We are in lockdown; sites are closed, projects are on hold, clients are cautious; almost uniformly, practices will both anticipate and see falling workloads in the next few months.

Through a variety of schemes, the government is supporting jobs and business, to preserve the capacity of our economy through the lockdown. Without them, the capacity of the economy to come back, post-crisis, would be severely diminished.

The length of the lockdown and the process for easing out of it is unclear. This lack of clarity feeds the uncertainty of economic forecasts. Perhaps the lockdown will only last another month or two: the lockdown has been relaxed in Wuhan and normality is beginning to return. Yet a vaccine is unlikely to be ready soon, future immunity is not fully understood, and so the path back to the status quo is not clear yet (and may never be).

Once out of lockdown, how will the economy, the construction industry and the architects’ market fare? We are beginning to see forecasters produce forecasts, or at least, ‘scenarios’.

Coming out of the blocks first, with the presciently entitled “Coronavirus: The world economy at risk” the OECD suggested, in early March, that the ‘longer-lasting and more intensive coronavirus outbreak’ we now have could see global growth could drop to 1.5% in 2020, down from an expected (and already weak) 2.9% in 2019.

The International Monetary Fund (IMF), coming later (in mid-April, and so with a better understanding of the effect of the crisis), gives an outlook of a global contraction in 2020 of 3%, with a 6.1% contraction among advanced economies. It also suggests that the UK economy will shrink by 6.5% this year, offset somewhat by 4% growth in 2021. The IMF sees not only a short term jolt to the economy but lasting damage extending into 2021 and beyond. In their words, "the output loss associated with this health emergency and related containment measures likely dwarfs the losses that triggered the global financial crisis".

Closer to home, the Office of Budget Responsibility (OBR) released an ‘illustrative scenario’ based on a three-month lockdown, then another three months’ of partial restrictions. Whilst the OBR assumes no lasting economic damage, the short term effects they describe are startling; for the general economy, a 35% drop in output in Q2 2020, for construction, an unprecedented 70% drop. With around a third of architectural revenue being associated with on-site work, such a drop in construction work will have, and is having, a marked effect on architectural workloads. Add to this the significant reduction in output of the general economy and client demand is likely to be very weak. On the upside, the scenario has GDP rising rapidly in Q3 and Q4, so that by Q1 2021, we are back on trend for growth, albeit with higher levels of unemployment.

So different organisations are painting slightly different pictures, but there’s widespread agreement that this quarter will be very tough for the economy, and even tougher for construction, and so architecture. The way out isn’t clear, and all models, scenarios and forecasts are caveated by the unknown of medical progress. Normality may resume as early as 2021. More likely, the effects of this crisis will be felt for years to come, just as the effects of the financial crisis were.

However long we’re in this for, one thing is clear; it is by protecting the capacity of the economy to produce (rather than protecting production per se) that the damage will be minimised. That’s why the government is investing so significantly in job protection and preserving businesses. Of course, it could do more, and the RIBA continues to point out where it needs to. But it is doing a lot; more than ever before. Preserving capacity is relevant to practices too; now is the time to identifying core capacities within a practice, and plan to preserve them.

When we do slowly emerge from lockdown, there will be changes. These may include; a greater emphasis on home working (and the small residential-to-office projects that may emerge from this), different patterns of working and commuting, and a demand to increase healthcare capacity. There will be long term shifts too, perhaps towards an urban architecture that can better facilitate social distancing, perhaps to an economy that relies less on people moving themselves about to do business, perhaps to greater digitisation and offsite construction.

For the first time in most of our lifetimes, we can see what an economic threat to our way of life looks like. This threat is much less significant than the economic threat posed by climate degradation. Perhaps seeing how fragile our way of life is will help spur the needed response to the climate emergency.

RIBA Head of Economic Research, Adrian Malleson,